Announcing Rally Ventures Fund IV

Fund IV will invest in early-stage business technology companies bringing transformative approaches to cloud infrastructure, fintech, SaaS+ and security.

We are excited to announce the close of Rally IV, a $250 million fund to invest in early-stage companies bringing innovative approaches to enterprise technology.

Rally had oversubscribed demand for this fourth fund, closing well above target, and bringing the firm’s total committed capital raised since inception to nearly $600 million. Rally closed its last fund of $150 million in 2018.

We’re proud to have the continued support of our existing limited partners and thrilled to be adding new investors with a long-term commitment to venture capital: a high-caliber group of endowments, foundations, family offices and corporate investors.

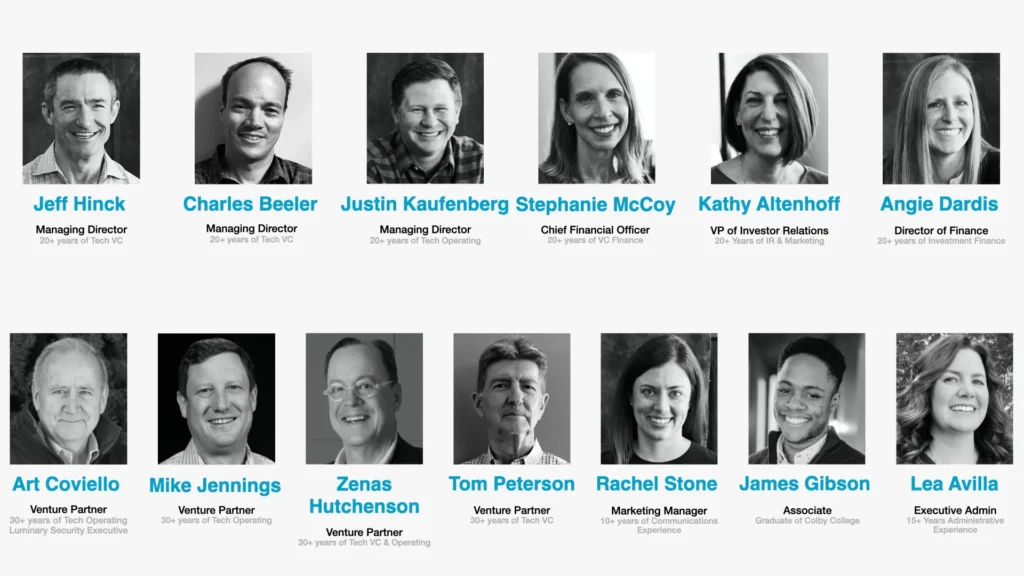

The Rally Ventures team has deep expertise investing in and operating enterprise technology businesses. The firm was founded in 2012 by Charles Beeler and Jeff Hinck, who have co-invested together for over 20 years. They’ve achieved top quartile performance in each and every fund in which they’ve been partners during their careers.

In late 2019, we welcomed our third partner, Justin Kaufenberg. Justin was previously the CEO of SportsEngine, a company he co-founded during the last market downturn and built to well over $100 million in revenue. Rally was a lead investor in SportsEngine and our team worked directly with Justin as he built the company from an early-stage opportunity to the largest sports-focused SaaS and payments company in the world.

In addition to the three partners, the Rally team consists of six professionals and four venture partners who bring a diverse set of backgrounds in investing, operations and support.

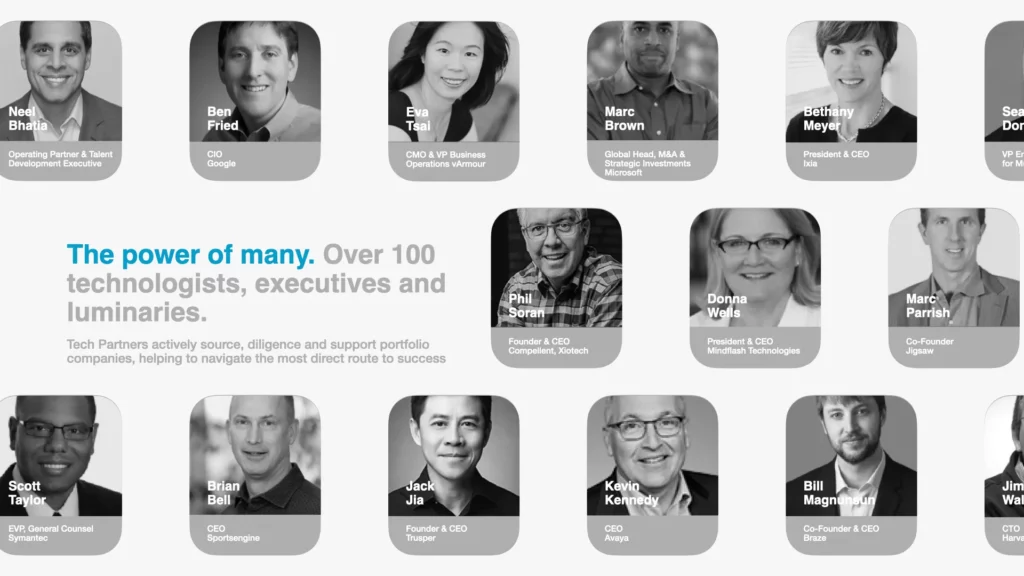

As a team, we pride ourselves on taking an in-depth operational approach to working with portfolio companies. Recognizing that no single individual has all the answers, Rally leverages the expertise of over 100 Rally Tech Partners — visionaries, technologists and executives with deep sector expertise — who help source, evaluate and support our early-stage companies.

The Tech Partners are a unique component of Rally’s approach to early-stage investing, and, as a group, they have invested over $100 million in the firm. Tech Partners provide Rally with an invaluable source of proprietary early-stage opportunities: Over 55% of the companies in the Rally portfolio were sourced by Tech Partners.

Most importantly, Tech Partners are an unparalleled source of wisdom and guidance for both Rally and our portfolio companies. Given their breadth of expertise, there are always members of the program who can add significant value to any company in the portfolio. On average, nearly ten Tech Partners are engaged with each portfolio company, with multiple companies having benefited from the involvement of more than twenty different Tech Partners.

In under a decade, Rally has invested in over 50 companies and built a nationwide portfolio of sector-spanning investments, with consistently strong performance across funds. We’ve been fortunate to partner with exceptional founders and teams building disruptive technologies. Notable investments include Braze, Bugcrowd, CrowdStreet, Total Expert, Carbon Black (IPO and subsequently acquired by VMware), Coupa (IPO), SportsEngine (acquired by NBC Sports), Twistlock (acquired by Palo Alto Networks) and Verodin (acquired by FireEye).

The market disruption caused by the COVID-19 pandemic has created a challenging environment for startup companies, with the depth and length of the economic downturn still unclear. The Rally Ventures strategy was developed in part based on our founders’ experience working through the prior two market downturns, and we have a strong history of success with early-stage companies regardless of the overall market environment.

Fund IV will continue our strategy of backing early-stage technology companies building innovative solutions for the fast-changing B2B landscape, focusing largely on Seed and Series A financing. Areas of investment will include cloud infrastructure, fintech, SaaS+ and security. We’re particularly keyed into three main areas of growth as we move into 2021:

- Cybersecurity. An order of magnitude increase in remote access of sensitive data creates critical new vulnerabilities in corporate security.

- Cloud Computing. The need for greater levels of remote access has dramatically accelerated the move to cloud computing and the tools to support this rapid shift.

- SaaS+. Rally has unique expertise in this strategy, with SportsEngine being one of the seminal examples of this emergent business model.

While 2020 has been a year of change, we’re looking forward to working with the next group of industry-altering entrepreneurs. We’re optimistic about the future and very excited for our next chapter!